This article was updated on June 22nd 2023.

- Services

- Corporate Services

- TAX SERVICES

- Corporate Tax

- Excise Tax

- Value Added Tax

(VAT) - ASSET PROTECTION &

ESTATE PLANNING - ECONOMIC SUBSTANCE

REGULATIONS (ESR) - M&A Tax &

Reorganisations - International Tax

Services - Tax Investigations

& Disputes - Transfer Pricing

- Withholding Tax

- Customs Duties

- Property Transfer Tax

- FATCA/CRS

- Tax Planning

- Tax Audit Representation

- Tax Residency Certificate Assistance

- [email protected]

- Dubai: +971 4 878 6240 Riyadh: +966 56 865 2329

Creation Business Consultants celebrates at CPA Australia Dubai Awards Ceremony at the Fairmont Dubai

June 6, 2022

FINDING THE PERFECT LAUNCHPAD: BEST LOCATIONS FOR TECH STARTUPS IN DUBAI

June 13, 2022

HOW TO SET UP & REGISTER A TRADING COMPANY IN THE UAE?

This article has been researched and written by Rehan Abid and the team at Creation Business Consultants and has not used AI in generating this article.

The UAE offers unique opportunities for all forms of entities – from start-ups and SMEs to large multinationals. The UAE has established itself as a global hub for entrepreneurs, business owners, and traders.

Among the list of benefits to set up a company in Dubai and the UAE is the option to engage in local and international trade. This is made possible through the country’s various jurisdictions. A wide range of prospects are available to foreign investors in Dubai and the UAE, especially in the commercial trading business. More than 2,000 licensed economic activities are available in all seven emirates, governed by relevant departments of economic development, municipalities, and free zones.

Corporates and individuals from all over the world can have complete ownership of companies in the UAE. This was made possible after the ratification of the Commercial Companies Law in 2020, now known as New Companies Law 2021, which allows foreigners to establish companies with 100 percent full ownership.

WHICH LOCATION IS SUITABLE TO START YOUR DUBAI / UAE TRADING COMPANY?

MAINLAND OR ONSHORE TRADING COMPANY

Your UAE trading company can benefit from setting up operations in the mainland by having access to the local market, free zones, and an international audience. Mainland companies are excellent options for retail, wholesale, and distribution businesses in the wider UAE market. Further, such companies are permitted to bid and secure local UAE government contracts. To register as a mainland company, a license from the Department of Economy and Tourism (DET) is mandatory. Listed below are the appropriate DED authorities for the respective emirates.

- Dubai – Department of Economy and Tourism (DET)

- Abu Dhabi – Abu Dhabi Department of Economic Development (ADDED)

- Sharjah – Sharjah Economic development department (SEDD)

- Ajman – Ajman Department of Economic Development (DED)

- Ras Al Khaimah – Department of Economic Development (RAK – DED)

- Umm Al Quwain – Department of Economic Development (DED)

- Fujairah – Fujairah Municipality (commercial license section)

STEPS TO BEGIN / REGISTER A TRADING BUSINESS IN UAE MAINLAND

- Only consult with a registered Corporate Service Provider to provide accurate and up-to-date details.

- Work with a consultant to choose your business activity, company, and shareholding structure.

- Select a preferred company name and secure the initial or preliminary approval.

- Secure any third-party government approval, if applicable to the selected business activity.

- Complete the company’s Memorandums and Articles of Association.

- Finalize the company’s registered address – a physical office, retail shop, or warehouse.

- License and registration to be completed with the relevant Department of Economic Development.

- Register the company with the Immigration Department to secure an Establishment Card.

- Register the company with the Ministry of Human Resources and Emiratization (MOHRE).

- Apply for the investor, employee, and dependents visas, etc.

- Complete all post-license processes such as Ultimate Beneficial Ownership registration.

- Open a corporate bank account.

FREE ZONE TRADING COMPANY

Free zones are economic areas in which goods and services can be traded with favorable tax and customs rates. Free zones usually offer plug-and-play options where investors can enjoy benefits such as 100 percent foreign ownership, 100 percent corporate tax exemption, 100 percent repatriation of capital funds, and a virtual office.

Free zone companies are not permitted to conduct commercial activities outside the free zone’s limits (in the wider UAE or Mainland); however, the license holder is permitted to operate outside of the UAE free zone (internationally). Local selling in mainland UAE is only possible through a distributor or an agent.

Free zones are an ideal solution for investors who are seeking opportunities in the import, export, and international trading business.

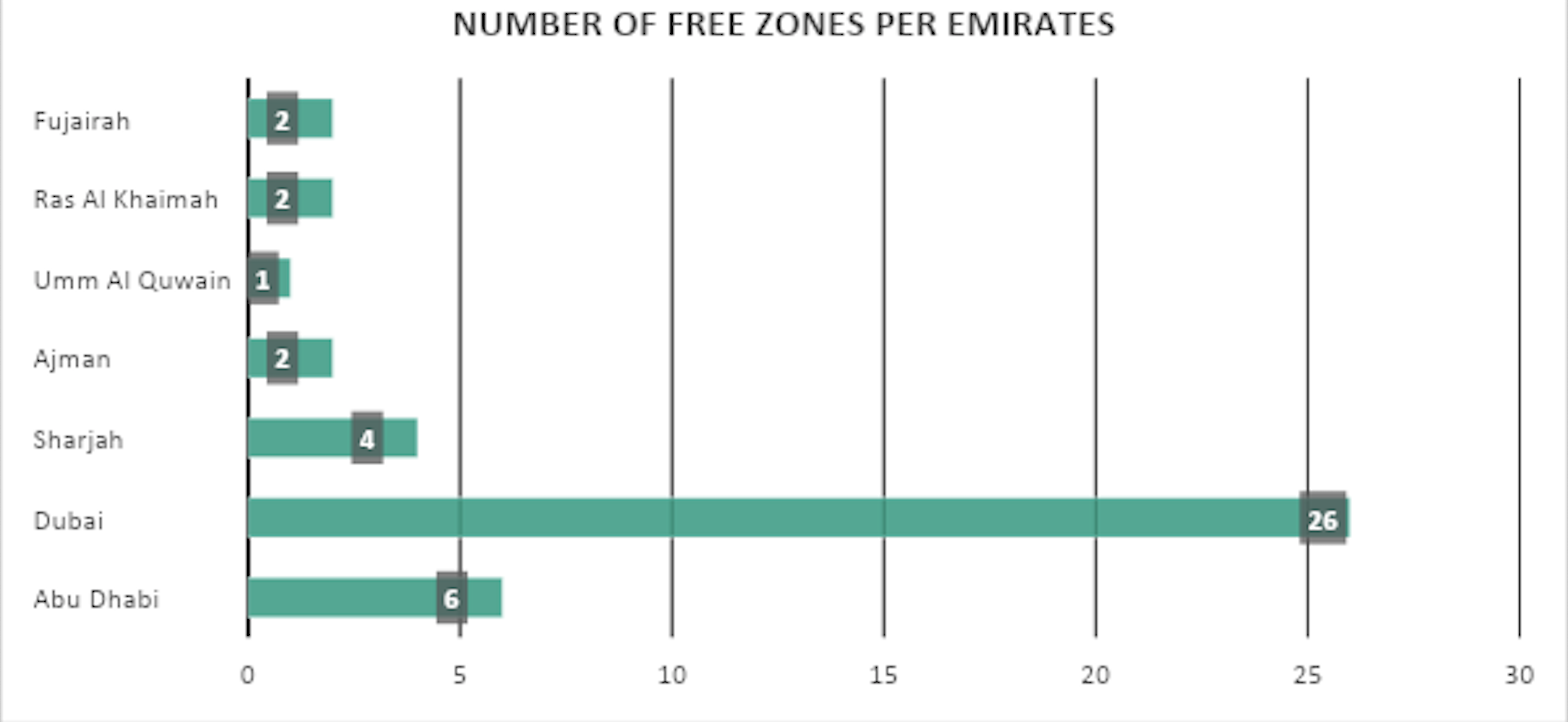

Below we have listed the main free zones within the UAE that may be suitable for your trading company.

ABU DHABI

- Abu Dhabi Airport Free Zone (ADAFZ)

- Abu Dhabi Global Markets (ADGM)

- Khalifa port Free Zone (KPFTZ – KIZAD)

- ZonesCorp – Industrial City of Al Ain / Abu Dhabi

- Masdar City

- Media Zone Authority (MZA) – Twofour54

DUBAI

- DP World

- Jabel Ali Free Zone (JAFZA)

- Dubai Auto Zone (DAZ)

- National Industries Park

- Dubai Development Authority (DDA)

- Dubai Internet City

- Dubai Media City

- Dubai Knowledge Park

- Dubai International Academic City

- Dubai Outsource City

- Dubai Production City

- Dubai Studio City

- Dubai Science Park

- Dubai Design District

- Emirates Towers

- Dubai Multi commodities center (DMCC)

- Dubai Internacional financial center (DIFC)

- Dubai World trade center (DWTC)

- Dubai world central (DWC)

- Dubai International airport free zone (DAFZ)

- Dubai Healthcare center (DHCC)

- Dubai Silicon Oasis (DSO)

- International Free Zone (IFZA)

- Meydan Free Zone

- Dubai Flower Center (DFC – Cargo Village Dubai Airport)

- International Humanitarian City (IHC)

- Dubai Industrial City

- Dubai textile City – Ports Customs and Free Zones Authority

SHARJAH

- Hamriyah Free Zone

- Sharjah Airport international free zone

- Sharjah Media City free zone

- Sharjah publishing city free zone

AJMAN

- Ajman Media City Free Zone

- Ajman Free Zone

RAS AL KHAIMAH

- RAK Economic Zone (RAKEZ) and RAK International Corporate Centre (RAKICC)

- RAK Maritime City – Saqr port

FUJAIRAH

UMM AL QUWAIN

STEPS TO START / REGISTER A TRADING BUSINESS IN A UAE FREE ZONE

- Only consult with a registered Corporate Service Provider to provide accurate, up-to-date details.

- Work with a consultant to choose your business activity, company, and shareholding structure.

- Select a preferred company name and receive the preliminary approval.

- Finalize the company’s registered address – a physical or virtual office.

- License and registration formalities to be completed with the relevant Free Zone authority.

- Register the company with the Immigration Department to secure an Establishment Card.

- Apply for the investor, employee, and dependents visas.

- Complete all post-license processes such as Ultimate Beneficial Ownership registration.

- Open a corporate bank account.

TAKEAWAY

There are many business setup options available in the UAE. Yet, it is important to seek the correct advice from a registered corporate service provider. Creation Business Consultants will guide you toward the appropriate license options, and recommend the correct jurisdiction that is appropriate for your UAE trading company for the present and the future of the company’s needs.

Our team of experts will liaise you with the proper authorities while simultaneously providing all the needed details to successfully set up your trading company in the UAE. Contact a member of our team to learn more, email us on [email protected] or call UAE +971 4 878 6240.

This Article was researched and written on Jun 6th, 2022 by Rehan Abid.

This Article was reviewed and updated on Sep 16th, 2024 by Thomas McNelliey.