This article was updated on June 13th, 2023

- Services

- Corporate Services

- TAX SERVICES

- Corporate Tax

- Excise Tax

- Value Added Tax

(VAT) - ASSET PROTECTION &

ESTATE PLANNING - ECONOMIC SUBSTANCE

REGULATIONS (ESR) - M&A Tax &

Reorganisations - International Tax

Services - Tax Investigations

& Disputes - Transfer Pricing

- Withholding Tax

- Customs Duties

- Property Transfer Tax

- FATCA/CRS

- Tax Planning

- Tax Audit Representation

- Tax Residency Certificate Assistance

- [email protected]

- Dubai: +971 4 878 6240 Riyadh: +966 56 865 2329

6 ONLINE CASHFLOW MANAGEMENT TIPS TO IMPROVE YOUR BUSINESS

October 13, 2020

Five Management Consultancy Trends for 2021 AS FEATURED ON Startup Terminal – Nov 04, 2020

November 5, 2020

ESTABLISHING RAK FOUNDATION & ASSET PROTECTION – THE HOW & WHY?

This article has been researched and written by Scott Cairns and the team at Creation Business Consultants and has not used AI in generating this article.

Many families and businesses are viewing asset protection and its preservation as a priority. The desire is to now consolidate assets by moving to restructuring and realigning their business interests and any new opportunities, domestically.

WHAT IS THE RAK FOUNDATION REGIME

Ras Al Khaimah International Corporate Centre (RAK ICC) launched its Foundation regime in 2019. RAK ICC enables the registration of a Foundation, that would be established by a Founder, donating assets towards specified charitable or non-charitable purposes.

The Foundation regime seems appealing to those clients who may not feel comfortable with the idea of a Trust or limitations on holding assets in certain jurisdictions by a Trust.

The regime ensures continuity of the foundation post the life of the Founder/s, hence making intergenerational planning of assets and legacy planning easier for many families and businesses alike.

The RAK ICC Foundation Regime is the result of global benchmarking, ensuring they meet the appropriate international standards and market requirements. The constitutional documents encompass the Foundation charter and its By-laws.

A Foundation essentially has a separate legal personality, distinct from the Founder. It allows the Foundation to enter contracts and/or hold assets in its own name. The Founder would have no further rights over the property in the foundation but can reserve a right to maintain considerable power within the By-laws, including the power to appoint and remove the Council or Guardian.

The concept of a Foundation is derived from civil law principles, whereas the notion of a Trust or a company is clearly classified within common law; a Foundations’ fundamental structure shares similar traits with both.

The Foundation as it is, is an orphan, without any shareholders, but may have a board, an assembly and voting members.

A Foundation can be used for several purposes, including but not limited to:

- Financial structuring.

- Succession and tax planning.

- Private wealth management and preservation.

- Asset protection, and by charitable institution.

EXAMPLE:

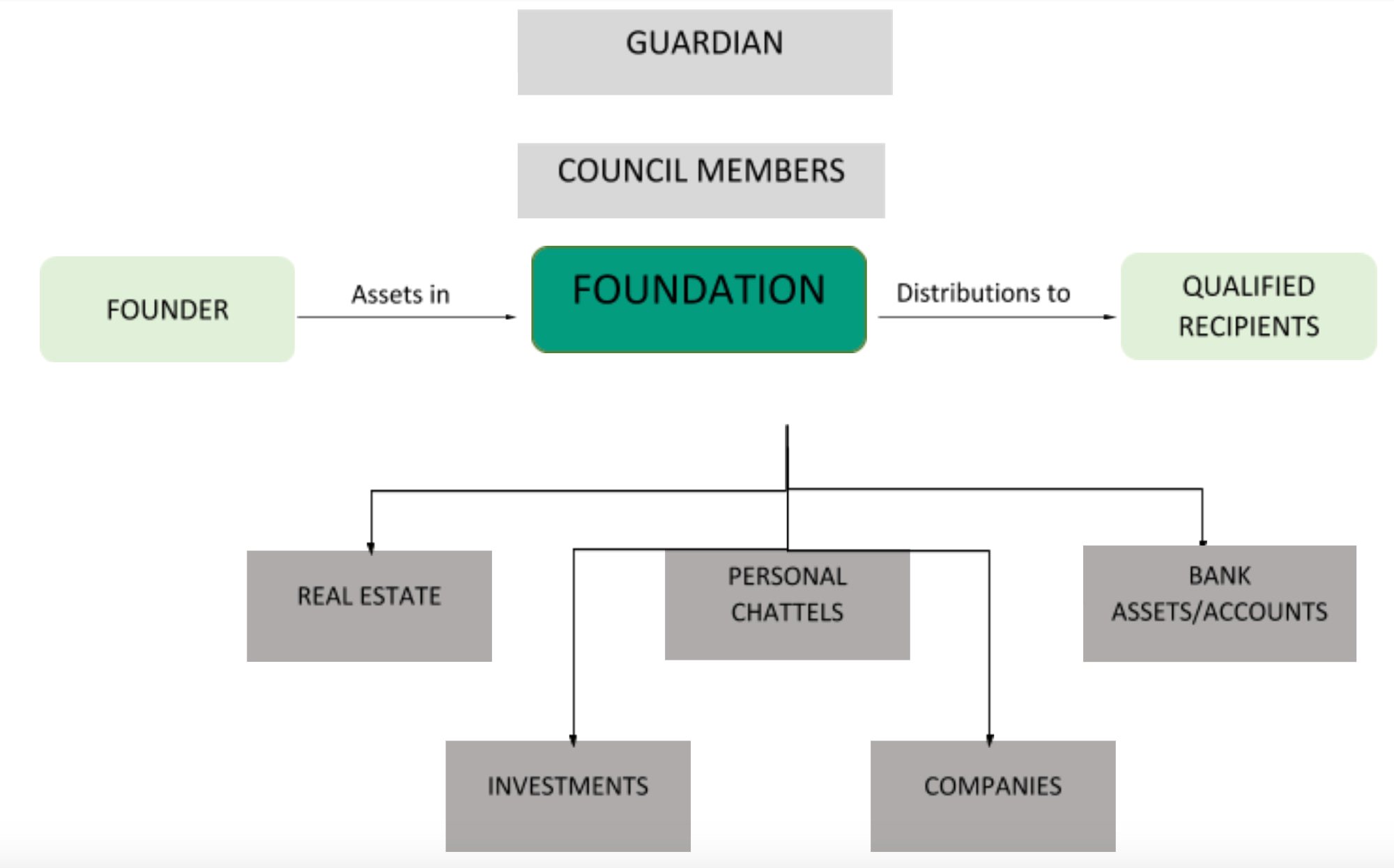

FOUNDATION STRUCTURE

KEY FEATURES OF ESTABLISHING RAK FOUNDATION COMPANY STRUCTURE:

- Governing Law: RAKICC Foundations Regime 2019.

- Constitutional documents: Must consist of The Charter and the By-Laws (Subjection to Regulation 14(4)).

- Founder: Is the individual or corporate body who contributes property to the Foundation to establish it.

- Qualified Recipient: The person or persons specified in the Charter and /or in line with the Charter and By-Laws, benefitting from the objects of the Foundation.

- Council Members (minimum of 2): Can be individuals or a corporate entity who would administer the Foundations property and carry out its objects under Regulation 18. This could be either the Founder, Family members, trusted and or professional advisors.

- Guardian: Supervises the Council Members and ensures strict adherence with regulation 20 of the RAKICC Foundation regime. A Guardian may be a Qualified Recipient and may be a legal person but may not be a Council Member.

- Privacy: The Registrar maintains a Foundations Register containing basic information. All other private information is not disclosed unless where required under the Laws, regulations, or rules of a governmental or regulatory authority.

- Flexibility: The continuity of a foreign Foundation to the RAKICC through migration as well as the continuation of a company incorporated under the RAKICC Business Companies Regulations 2018. Following a unanimous resolution of all shareholders, the company can apply for a Certificate of Continuance under these Regulations and preserve the company as a Foundation. If satisfied, Charter of Continuance would become the Charter thereof replacing the company’s Memorandum of Articles and Association.

- Legal Jurisdiction: Disputes can be held in the ADGM or DIFC courts; whichever selected in the Foundation Charter and the By-Laws.

- Minimum initial capital: To register a RAKICC foundation, one must contribute a minimum of USD $100, or it is equivalent in any currency. Any further property can subsequently be contributed into the Foundation.

- Annual Returns: Must be filed with the registrar.

- Registration: A Foundation must have an authorised registered agent and a registered office in the jurisdiction, such as Creation Business Consultants.

Are you still second-guessing with the idea to establish a RAK ICC Foundation? Whilst there are many benefits associated with establishing a RAK ICC Foundation, it is important to engage with a professional registered Corporate Service Provider that can recommend the best course of action for you. For further information and free expert consultation regarding setting up a RAK company or RAKICC Foundation structure email [email protected] or call +971 4 878 6240.

This article does not constitute legal, tax or professional advice. Governing Law – The RAKICC Foundations Regime 2019