WHAT IS A DIFC

PRESCRIBED COMPANY?

A DIFC Prescribed Company, a DIFC business structure, is a type of private company limited by shares established in the Dubai International Financial Centre (DIFC). Prescribed Companies are designed as flexible, cost-efficient corporate vehicles, primarily used as holding companies or special purpose vehicles (SPVs) for structuring transactions, financing, or asset holding, particularly for family businesses, private wealth structures, funds, and private equity firms.

WHO SHOULD CONSIDER A DIFC PRESCRIBED COMPANY?

DIFC Prescribed Companies are designed to serve a diverse range of users with specific structuring needs. Creation Business Consultants provides end-to-end support—including corporate structuring, tax advisory, and ongoing business compliance, tailored to the following categories:

- Family Offices: High-net-worth families consolidating assets or structuring wealth for succession planning, particularly through family holding structures.

- Global Investors: Individuals or entities seeking to hold GCC-based assets (e.g., real estate, shares) in a tax-efficient, secure jurisdiction.

- Funds and Financial Institutions: DFSA-regulated firms or funds in recognized jurisdictions using Prescribed Companies for structured financing or asset management.

- Businesses with Specific Purposes: Companies involved in aviation, maritime, crowdfunding, or intellectual property transactions requiring a holding vehicle.

- International Businesses: Entities without an existing presence in the DIFC can now establish Prescribed Companies, making the jurisdiction accessible to a global audience.

BENEFITS OF CHOOSING A DIFC PRESCRIBED COMPANY

Here’s why a DIFC Prescribed Company stands out:

QUALIFYING PURPOSES

OF A DIFC PRESCRIBED

COMPANY

A DIFC Prescribed Company can only be established for specific, pre-approved activities known as qualifying purposes. The entity must not carry out regulated financial services unless it supports a licensed firm. These restrictions ensure the Prescribed Company remains a cost-effective, compliant solution for targeted structuring needs within the DIFC framework. Creation Business Consultants works closely with clients to identify the most suitable qualifying purpose, ensuring each structure meets DIFC requirements while achieving strategic business or investment goals.

STRUCTURED FINANCING

Prescribed Companies are commonly used as SPVs to support complex financial arrangements, including securitization, syndicated lending, and off-balance sheet transactions.

HOLDING ASSETS

Prescribed Companies can hold a wide range of assets, particularly those classified as GCC Registrable Assets, such as:

- Real estate located in the GCC

- Shares in companies

- Intellectual property (IP)

- Interests in partnerships

- Aircraft or maritime vessels registered in the GCC

AVIATION AND MARITIME STRUCTURES

They are suitable for facilitating the ownership, leasing, and financing of aircraft or marine vessels. This includes cross-border leasing arrangements and financing structures involving multiple parties.

INTELLECTUAL PROPERTY (IP) MANAGEMENT

Prescribed Companies can be used to own, manage, and license IP assets, offering a secure and tax-neutral environment for innovation-driven businesses and investors.

CROWDFUNDING STRUCTURES

They can act as asset-holding entities for crowdfunding platforms, ensuring proper segregation of investor assets and compliance with evolving regulatory standards.

SUCCESSION AND WEALTH PLANNING

Family offices and high-net-worth individuals often use Prescribed Companies to create family holding structures, enabling long-term asset preservation, inheritance planning, and intergenerational wealth transfer.

CASE STUDY: INNOTECH’S DIFC PRESCRIBED COMPANY FOR AI IP PROTECTION AND TAX-FREE GROWTH

Scenario

Imagine a technology startup, “InnoTech,” based in Dubai, developing a proprietary AI software platform. The founders, a group of international investors, decide to establish a DIFC Prescribed Company structure to optimize their business operations and IP management.

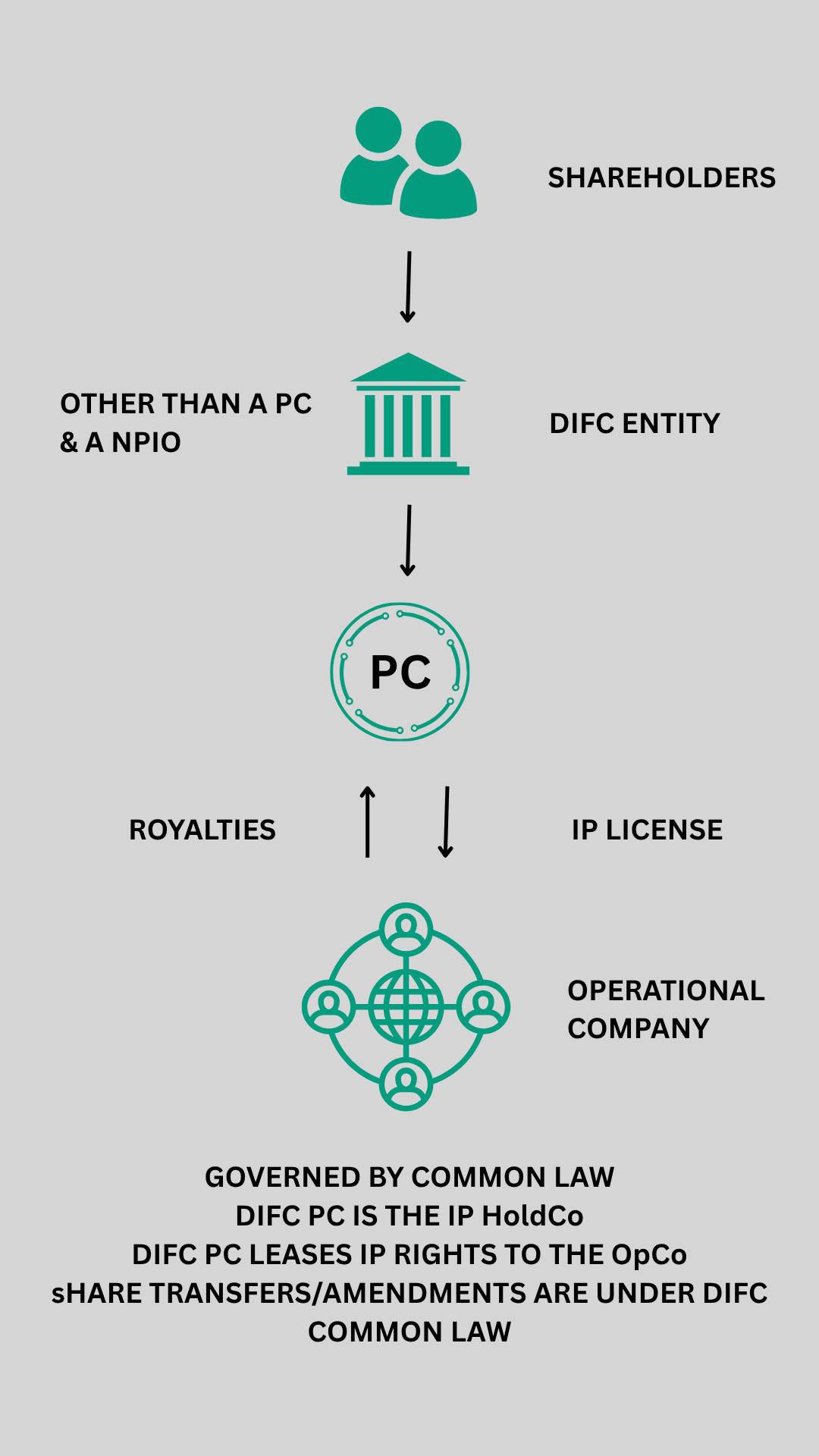

Structure Implementation

- Formation of DIFC PC (IP HoldCo):

- InnoTech establishes a DIFC PC, “InnoTech IP HoldCo,” registered under DIFC Common Law. The shareholders include the founding investors and a venture capital firm from Singapore.

- The PC holds the AI software’s IP rights, including patents and trademarks.

- Leasing IP to Operational Company:

- InnoTech sets up an Operational Company, “InnoTech Solutions,” in the UAE mainland to market and deploy the AI software.

- InnoTech IP HoldCo leases the IP rights to InnoTech Solutions under a licensing agreement, charging a 5% royalty on the OpCo’s annual revenue.

- Revenue and Tax Benefits:

- InnoTech Solutions generates $10 million in revenue annually. It pays $500,000 in royalties to InnoTech IP HoldCo.

- The DIFC PC benefits from DIFC’s 0% corporate tax rate on income, including royalties, maximizing profit retention for shareholders.

- Shareholder Flexibility:

- As the business grows, the Singapore VC firm exits, and a new investor from the US joins. Share transfers are seamlessly managed under DIFC Common Law, ensuring compliance and efficiency.

Benefits of the DIFC Prescribed Company Structure

- Tax Optimization: The 9% corporate tax rate in DIFC allows InnoTech IP HoldCo to retain 100,000 royalty income, and only pay 9% on 400,000 USD. Enhancing profitability compared to jurisdictions with higher tax rates.

- IP Protection and Monetization: Centralizing IP ownership in the DIFC PC provides robust legal protection under Common Law. Leasing IP to the OpCo creates a steady royalty income stream, diversifying revenue sources.

- Operational Flexibility: The separation of IP ownership (DIFC PC) and operations (OpCo) allows InnoTech to scale operations across different jurisdictions while maintaining control over its core IP assets.

- Investor Attraction: The clear legal framework and tax advantages of DIFC attract international investors, as seen with the smooth share transfer process, boosting confidence and funding opportunities.

- Regulatory Advantage: Governed by Common Law, the structure aligns with international business standards, making it appealing for global partnerships and reducing legal complexities.

Conclusion

The DIFC Prescribed Company structure enabled InnoTech to efficiently manage its IP, optimize tax liabilities, and attract global investment. This case study highlights how such a structure can support innovative businesses by providing a secure, flexible, and cost-effective framework for IP-driven enterprises.

ELEMENTS OF THE DIFC PC IP LICENSING FLOWCHART

KEY NOTES

LAUNCH YOUR DIFC PRESCRIBED COMPANY WITH US

Streamlined solutions for your DIFC setup and success.

EXPERT CONSULTATION

Partner with Creation Business Consultants for strategic advice on how a DIFC Prescribed Company can support your investment, structuring, or wealth planning objectives.

BUSINESS REVIEW AND STRATEGY

Our experts in corporate structuring, tax, and compliance guide you to select the optimal structure, license, and shareholding framework.

SEAMLESS LICENSING & BANKING

Focus on growing your business while we manage:

- Company name selection and initial approvals

- Regulatory approvals and documentation

- Registered address and post-incorporation steps

- Corporate bank account setup

ONGOING BUSINESS & COMPLIANCE SUPPORT

Our support doesn’t end once your Prescribed Company is established. We provide ongoing assistance to help you remain compliant with local regulations and succeed in the fast-paced markets of Dubai and the UAE.

EXPLORE OTHER DIFC COMPANY STRUCTURES

DIFC FOUNDATION

A tax-efficient entity for wealth protection, family planning, philanthropy, and holding assets in a secure jurisdiction.

DIFC HOLDING COMPANY

A strategic entity to manage equity and assets in subsidiaries, enabling efficient control and group operations.

DIFC FAMILY OFFICE

A regulated platform for managing family wealth, governance, and legacy planning in a globally trusted financial hub.

DIFC PRESCRIBED COMPANY FAQs

Yes. Individuals or companies outside the UAE can establish a DIFC Prescribed Company by appointing a DIFC-registered corporate service provider, like Creation, to provide a registered office address and manage the incorporation process.

No. A DIFC Prescribed Company does not require a physical office or local employees. Creation can provide the registered address and ongoing support, so you can manage your company from anywhere.

No, there is no fixed minimum capital requirement to set up a DIFC Prescribed Company. You can define the share capital based on your specific business needs, investment structure, or holding purpose.

Yes, a DIFC Prescribed Company can open corporate bank accounts in the UAE or internationally. However, account approval is subject to each bank’s internal compliance and due diligence procedures.

A DIFC Prescribed Company can be used within various structures, including family holding entities, SPVs under offshore parent companies, fund or investment vehicles, and cross-border financing arrangements.

As a DIFC-registered corporate service provider, Creation offers deep regulatory knowledge, tax advisory, and hands-on support—covering everything from incorporation to ongoing compliance and structuring strategy.