WHAT IS A DIFC

HOLDING COMPANY?

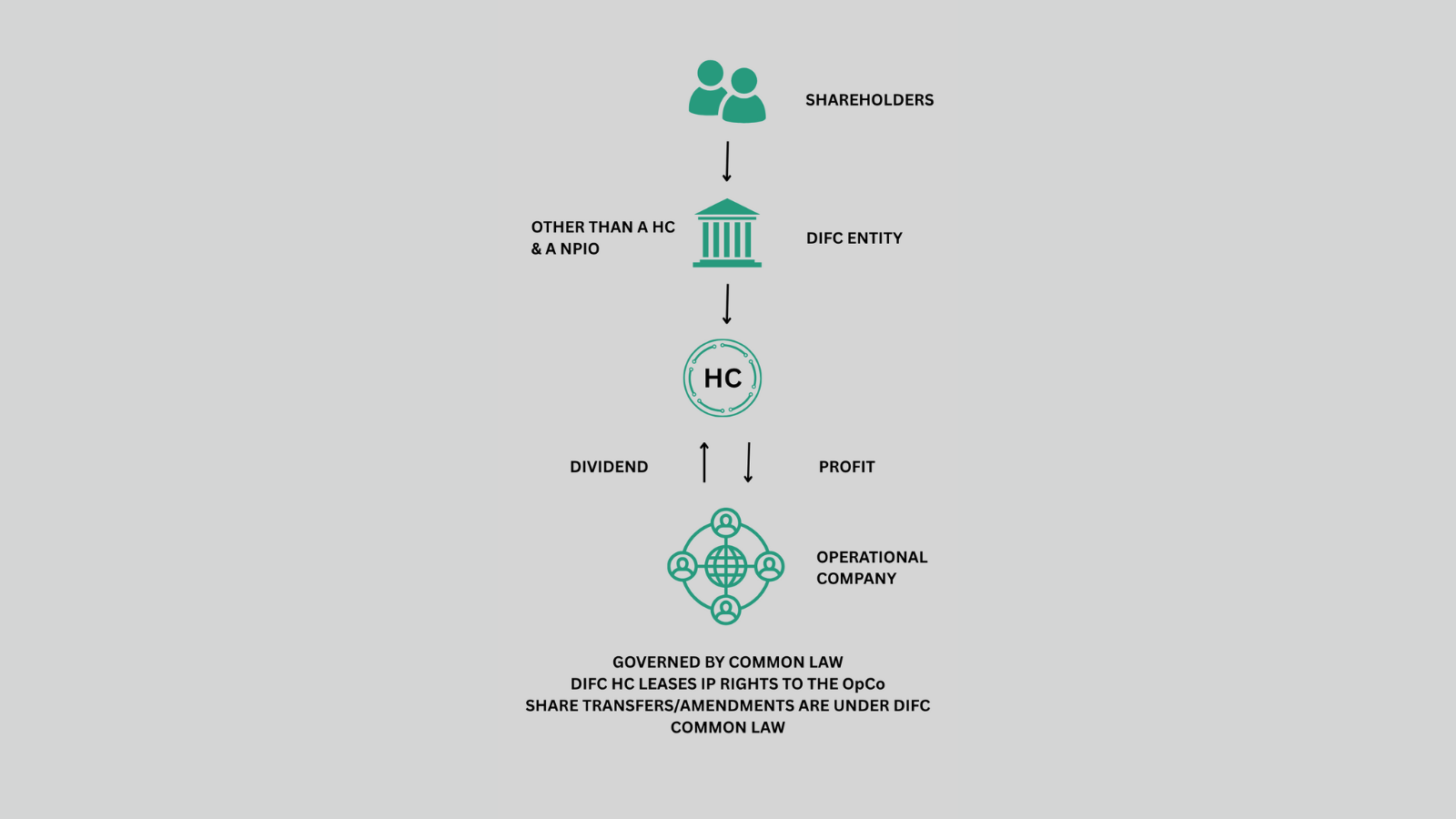

A DIFC Holding Company, a DIFC business structure, is a powerful corporate vehicle established within the Dubai International Financial Centre (DIFC) to consolidate ownership of multiple subsidiaries, assets, and investments under a single, tax-efficient entity.

Leveraging DIFC’s world-class regulatory environment, investor-friendly legislation, and international reputation, holding companies offer a robust platform for global business expansion, asset protection, and long-term wealth management.

COMPARING DIFC HOLDING COMPANIES WITH MAINLAND & FREE ZONE ENTITIES

WHO SHOULD CONSIDER A DIFC HOLDING COMPANY?

DIFC Holding Companies are ideal for:

- High-Net-Worth Individuals (HNWIs): Seeking a secure and tax-efficient structure to hold personal and family wealth, real estate, and shares in various companies.

- Family Offices: Centralizing control of diversified family-owned assets and investment vehicles across jurisdictions.

- International Corporations: Managing regional or global subsidiaries under a unified corporate umbrella.

- Private Investors & Fund Managers: Consolidating investments in startups, venture capital, private equity, or real estate portfolios.

Entrepreneurs & Business Owners: Structuring intellectual property, trademarks, and commercial operations for tax efficiency and succession planning.

BENEFITS OF A DIFC HOLDING COMPANY

Setting up a holding company in the DIFC offers a range of strategic, legal, and financial advantages. Whether you’re managing global investments, structuring a family office, or consolidating business assets, DIFC provides a premium jurisdiction that supports long-term growth and asset protection.

KEY PURPOSES OF SETTING UP A DIFC HOLDING COMPANY

A DIFC holding company is more than a passive asset-holding vehicle — it’s a powerful structure used by investors, entrepreneurs, and families to implement long-term financial and governance strategies. Here are five primary purposes:

CASE STUDY: ESTABLISHING A HOLDING COMPANY IN DIFC

Introduction

The Dubai International Financial Centre (DIFC) is a premier financial hub in the Middle East, Africa, and South Asia (MEASA) region, offering a common law-based legal framework, tax-neutral environment, and robust infrastructure for businesses. This case study examines the establishment of a DIFC Holding Company by the Al-Nasser Group, a diversified business conglomerate, to centralize ownership, streamline operations, and optimize its global investment portfolio.

Background

The Al-Nasser Group, headquartered in Dubai, operates businesses in real estate development, logistics, and renewable energy across the UAE, Saudi Arabia, and Europe. With assets valued at approximately USD 750 million, the group’s portfolio includes subsidiaries in multiple jurisdictions, each with distinct operational and tax requirements. The group’s leadership sought to consolidate ownership, enhance corporate governance, and facilitate cross-border investments while leveraging the DIFC’s tax and regulatory advantages.

The Al-Nasser Group decided to establish a DIFC Holding Company to serve as the central entity for owning and managing its subsidiaries, optimizing capital flows, and supporting future expansion.

Objectives

The Al-Nasser Group aimed to achieve the following through the DIFC Holding Company:

- Centralized Ownership: Consolidate ownership of subsidiaries under a single entity to simplify management and governance.

- Tax Efficiency: Leverage the DIFC’s zero-tax regime and the UAE’s double taxation treaty network to optimize returns on dividends and capital gains.

- Capital Flow Management: Streamline the flow of dividends, loans, and investments between subsidiaries and the holding company.

- Risk Mitigation: Ring-fence liabilities by structuring subsidiaries under the holding company to protect group assets.

- Global Expansion: Facilitate acquisitions and investments in new markets using the DIFC’s reputable and business-friendly framework.

Solution: DIFC Holding Company Structure

The Al-Nasser Group incorporated a DIFC Holding Company as a Company Limited by Shares under the DIFC Companies Law. This structure was chosen for its flexibility, ability to hold diverse assets, and alignment with international corporate standards.

Key Features of the DIFC Holding Company

- Legal Structure: The holding company was established as a DIFC Company Limited by Shares, with the Al-Nasser Group’s family members and key stakeholders as shareholders.

- Regulatory Status: Registered as a Non-Regulated Entity with the DIFC Authority, as it primarily held shares and assets without conducting regulated financial activities requiring Dubai Financial Services Authority (DFSA) oversight.

- Asset Holding: The holding company owned shares in subsidiaries operating in real estate (UAE), logistics (Saudi Arabia), and renewable energy (Germany). It also held intellectual property and cash reserves.

- Governance: A board of directors, comprising family members and independent professionals, was appointed to oversee strategic decisions. A corporate governance policy was implemented to ensure transparency and accountability.

- Tax Benefits: The DIFC’s zero-tax regime on corporate income, capital gains, and dividends, combined with the UAE’s double taxation treaties with over 100 countries, minimized tax liabilities on cross-border transactions.

Implementation Steps

- Incorporation: The group engaged a DIFC-registered corporate service provider to incorporate the holding company. The process involved submitting a business plan, shareholder details, and compliance declarations to the DIFC Authority. Incorporation was completed in 10 business days.

- Share Transfer: Shares of the group’s subsidiaries were transferred to the DIFC Holding Company through a share purchase agreement, ensuring legal ownership was centralized. This required coordination with legal advisors in the UAE, Saudi Arabia, and Germany to comply with local regulations.

- Office Setup: A physical office was leased in the DIFC to meet the requirement for a registered address. A flexi-desk option was initially used to manage costs.

- Financial Infrastructure: A corporate bank account was opened with a DIFC-based bank to facilitate transaction flows, including dividends and intercompany loans. The holding company adopted International Financial Reporting Standards (IFRS) for financial reporting.

- Compliance: A compliance officer was appointed to ensure adherence to DIFC’s anti-money laundering (AML) and know-your-customer (KYC) regulations. Annual audits were mandated to maintain transparency.

- Operational Setup: The holding company employed a lean team, including a CFO and legal counsel, to manage subsidiary oversight, financial reporting, and strategic investments.

Transaction Flow

The DIFC Holding Company served as the central hub for managing financial and operational interactions among subsidiaries. The transaction flow included:

- Dividend Upstream: Subsidiaries generated profits from their operations (e.g., real estate rental income, logistics revenue, and renewable energy sales). These profits were distributed as dividends to the DIFC Holding Company. For example, the UAE real estate subsidiary paid USD 10 million in dividends in 2024, tax-free under DIFC regulations.

- Intercompany Loans: The holding company provided loans to subsidiaries for expansion projects. For instance, a USD 15 million loan was extended to the German renewable energy subsidiary to fund a new solar project, with interest payments flowing back to the holding company.

- Investment Allocation: The holding company pooled capital from dividends and loans to invest in new opportunities. In 2024, it allocated USD 20 million to acquire a minority stake in a Singapore-based tech startup, leveraging the DIFC’s tax-neutral status to avoid capital gains tax.

- Royalty and IP Payments: The holding company owned the group’s trademarks and licensed them to subsidiaries. For example, the logistics subsidiary in Saudi Arabia paid USD 2 million annually in royalty fees to the holding company for brand usage.

- Centralized Treasury Management: The holding company managed excess cash reserves, placing them in low-risk DIFC-based investment funds to generate returns while maintaining liquidity for future acquisitions.

Utility of the DIFC Holding Company

- Centralized Control: Consolidated ownership simplified oversight of subsidiaries, reducing administrative complexity and improving strategic alignment.

- Tax Optimization: The zero-tax environment and access to double taxation treaties minimized tax liabilities on dividends, interest, and capital gains, enhancing group profitability.

- Risk Management: The holding structure isolated liabilities at the subsidiary level, protecting the group’s core assets from operational or legal risks.

- Global Credibility: The DIFC’s reputation as a well-regulated financial hub enhanced the group’s credibility when negotiating international deals or securing financing.

- Flexibility for Growth: The holding company facilitated acquisitions and investments by providing a single entity to manage capital allocation and deal structuring.

Outcomes

- Streamlined Operations: Centralized ownership reduced administrative costs by 15% and improved decision-making efficiency across subsidiaries.

- Tax Savings: The DIFC’s tax-neutral regime saved the group approximately USD 8 million in taxes on dividends and capital gains in the first year.

- Enhanced Governance: The board and corporate governance policy ensured transparency and alignment with the group’s long-term vision.

- Successful Expansion: The holding company’s investment in the Singapore tech startup yielded a 12% return in 2024, demonstrating its ability to support growth.

- Risk Mitigation: The holding structure protected the group’s assets from a legal dispute involving the logistics subsidiary in Saudi Arabia, limiting liability exposure.

Challenges and Considerations

- Setup Costs: Initial incorporation and legal fees totaled USD 60,000, with ongoing costs (office, staff, compliance) estimated at USD 150,000 annually.

- Cross-Jurisdictional Compliance: Transferring shares and managing transactions across jurisdictions required coordination with international legal and tax advisors, increasing complexity.

- Regulatory Oversight: While non-regulated, the holding company had to comply with DIFC’s AML, KYC, and financial reporting requirements, necessitating robust internal controls.

- Currency Risks: Cross-border transactions exposed the group to currency fluctuations, mitigated through hedging strategies implemented by the holding company’s treasury team.

Conclusion

The establishment of a DIFC Holding Company provided the Al-Nasser Group with a tax-efficient, flexible, and reputable platform to manage its global subsidiaries, streamline transaction flows, and support expansion. The DIFC’s common law framework, zero-tax regime, and access to international treaties made it an ideal jurisdiction for the holding company. Despite setup costs and cross-jurisdictional complexities, the benefits of centralized control, tax optimization, and risk management outweighed these challenges.

LAUNCH YOUR DIFC HOLDING COMPANY WITH US

Strategic structures for long-term asset protection, growth, and legacy planning.

EXPERT STRUCTURING CONSULTATION

Partner with Creation Business Consultants for customized advice on setting up your DIFC holding company to meet your investment, asset protection, and succession planning goals.

STRUCTURE DESIGN & LEGAL STRATEGY

Our corporate structuring, governance, and compliance specialists will help you:

- Select the optimal legal entity type

- Define shareholder and board structures

- Align your holding company with estate planning tools like DIFC Wills and Foundations

FULL-SERVICE REGISTRATION & BANKING

Focus on your portfolio while we handle the setup, including:

- Company name reservation and approvals

- Registrar of Companies (RoC) application and documentation

- Lease/flexi-desk setup and registered address

- Assistance with corporate bank account opening, locally or internationally

Enjoy a seamless, fully compliant DIFC holding company formation experience.

POST-SETUP & LONG-TERM SUPPORT

We continue supporting your holding structure with:

- Annual filings and regulatory compliance

- Restructuring, share transfers, and corporate changes

- Integration with family office governance, Wills, or Trusts

Build a future-ready holding company with the ongoing support of Creation Business Consultants.

EXPLORE OTHER DIFC COMPANY STRUCTURES

DIFC PRESCRIBED COMPANY

A cost-effective entity used for holding assets, intellectual property (IP), or facilitating transactions within the DIFC’s trusted, and regulated ecosystem.

DIFC FOUNDATION

A tax-efficient entity for wealth protection, family planning, philanthropy, and holding assets in a secure jurisdiction.

DIFC FAMILY OFFICE

A regulated platform for managing family wealth, governance, and legacy planning in a globally trusted financial hub.

DIFC HOLDING COMPANY FAQs

Yes. The DIFC allows 100% foreign ownership, meaning you don’t need a UAE national sponsor. This provides full control over your assets and decision-making processes.

No, there is no minimum share capital requirement for passive holding companies in the DIFC. This makes it a cost-efficient structure for asset consolidation and long-term ownership.

DIFC companies benefit from 0% corporate tax on qualifying income, no personal income tax, and access to the UAE’s wide network of double tax treaties, making it highly tax-efficient for asset and investment holding.

It can hold shares in other companies, intellectual property (IP), real estate (through subsidiaries or SPVs), financial instruments, or any other lawful investment.

No, for passive entities, a flexi-desk or virtual office within the DIFC is sufficient. This allows you to establish a legal presence without the cost of maintaining a full-time office.

The timeline can range from 2 to 4 weeks, depending on document readiness and regulatory approval. Creation streamlines this process to minimize delays and ensure full compliance.

Yes. The DIFC operates under an independent legal system based on English Common Law, giving you access to the DIFC Courts and arbitration services. This adds clarity, transparency, and global recognition to your corporate structure.

With extensive experience in DIFC structuring, compliance, and private wealth advisory, Creation provides end-to-end guidance — from licensing, company structuring, tax advisory and services to bank account support and long-term compliance. Our team ensures your structure is robust, compliant, and future-ready.