WHAT IS A DIFC

FOUNDATION?

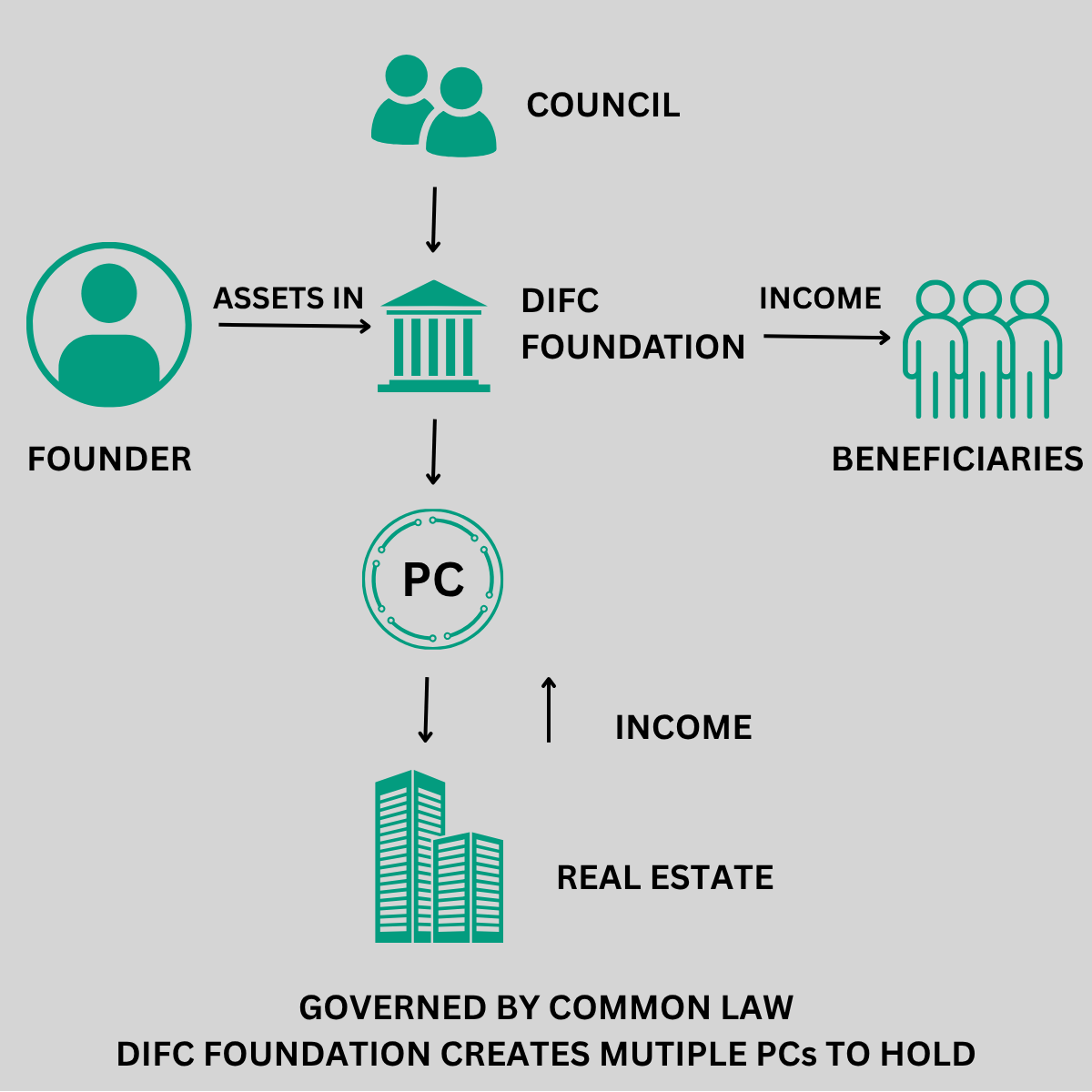

A DIFC Foundation, a DIFC business structure, is an independent legal entity established under the DIFC Foundations Law No. 3 of 2018, capable of owning assets in its own name. Administered by the DIFC Registrar of Companies, it offers a robust structure for wealth management, estate planning, or charitable purposes.

Unlike a trust, which relies on trustees, a DIFC Foundation is governed by a Council and may include a Founder, Beneficiaries, and an optional Guardian. It has no shareholders or members, ensuring flexibility and control for its purpose.

WHO SHOULD CONSIDER A DIFC FOUNDATION?

A DIFC Foundation is a versatile solution for managing and protecting wealth and assets, ideal for:

- Wealthy individuals seeking estate planning and asset protection

- Family businesses planning for long-term succession and continuity

- Investors structuring multi-generational wealth for future generations

- Charitable or non-profit initiatives focused on sustainable giving

- Corporate entities managing specialized needs, such as holding intellectual property or investment portfolios

Contact Creation Business Consultants to explore how a DIFC Foundation can meet your goals.

KEY BENEFITS OF A DIFC FOUNDATION

A DIFC Foundation offers powerful advantages for wealth management, asset protection, and achieving your financial or philanthropic goals.

COMMON PURPOSES OF SETTING UP A DIFC FOUNDATION

DIFC Foundations serve a wide range of purposes, tailored to meet personal, family, or business objectives.

CASE STUDY: AHMED FAMILY FOUNDATION IN DIFC FOR WEALTH MANAGEMENT AND PHILANTHROPY

Scenario

Consider a wealthy entrepreneur, Mr. Ahmed, who wishes to secure his family’s financial future and support charitable causes. Based in Dubai, he establishes a DIFC Foundation, “Ahmed Family Foundation,” to manage his diverse asset portfolio.

Structure Implementation

- Establishment of DIFC Foundation:

- Mr. Ahmed sets up the Ahmed Family Foundation under DIFC Common Law, appointing a council comprising family members and a trusted financial advisor to oversee operations.

- He transfers assets worth $50 million, including cash, stocks, and real estate holdings, into the Foundation.

- Creation of Prescribed Companies (PCs):

- The Foundation creates three PCs:

- “Ahmed Real Estate PC” to manage a portfolio of commercial properties in Dubai.

- “Ahmed Investments PC” to handle stock market investments.

- “Ahmed Charity PC” to support educational initiatives.

- Each PC is tailored to a specific sector, optimizing management and compliance.

- The Foundation creates three PCs:

- Income Generation and Distribution:

- Ahmed Real Estate PC generates $2 million annually from property rentals, which flows back to the Foundation.

- Ahmed Investments PC earns $1.5 million from stock dividends.

- The Foundation distributes $1 million to beneficiaries (e.g., Mr. Ahmed’s children and grandchildren) and allocates $500,000 to charitable causes via Ahmed Charity PC.

- Long-Term Planning:

- As Mr. Ahmed ages, he updates the beneficiary list to include a new grandchild, a process facilitated by the flexible governance of DIFC Common Law.

Benefits of the DIFC Foundation Structure

- Asset Protection: The Foundation shields Mr. Ahmed’s $50 million asset base from personal creditors or legal disputes, ensuring long-term security for his family.

- Tax Efficiency: With DIFC’s 0% corporate tax rate, the Foundation retains the full $3.5 million annual income, maximizing funds available for beneficiaries and charitable activities.

- Sector-Wise Diversification: Creating multiple PCs allows targeted management of real estate, investments, and charity, reducing risk and enhancing returns across sectors.

- Succession Planning: The structure provides a clear mechanism for distributing income to beneficiaries, ensuring Mr. Ahmed’s wealth supports his family across generations with minimal legal hurdles.

- Charitable Impact: The Ahmed Charity PC enables structured philanthropy, such as funding schools in underserved areas, aligning with Mr. Ahmed’s legacy goals while offering tax and legal benefits.

Conclusion

The DIFC Foundation structure empowered Mr. Ahmed to protect his wealth, diversify investments, and plan for his family’s future and charitable endeavors. This case study demonstrates how the structure’s flexibility under Common Law and tax advantages make it an effective tool for high-net-worth individuals seeking robust estate and investment management.

ELEMENTS OF THE DIFC FOUNDATION FLOWCHART

KEY NOTES

ESTABLISH YOUR DIFC FOUNDATION WITH US

Purpose-driven structuring for asset protection, succession, and legacy planning.

EXPERT CONSULTATION

Partner with Creation Business Consultants for tailored advice on how a DIFC Foundation can support your wealth preservation, succession planning, charitable giving, or corporate structuring goals.

PURPOSE & STRUCTURE DESIGN

Our specialists in estate planning, governance, and compliance help you define the foundation’s purpose, design a suitable governance framework, and align it with your personal, family, or business goals.

SEAMLESS REGISTRATION & ASSET TRANSFER

While you focus on your long-term goals, we manage:

- Drafting of the Charter and By-laws

- DIFC Registrar applications and approvals

- Appointment of Council members and Guardian (if required)

- Support with asset transfer documentation (e.g., real estate, IP, shares)

ONGOING FOUNDATION & COMPLIANCE SUPPORT

We continue to support you after the foundation is established with:

- Annual compliance and updates to the Registrar

- Governance reviews and documentation updates

- Strategic advice for asset management and beneficiary provisions

EXPLORE OTHER DIFC COMPANY STRUCTURES

DIFC PRESCRIBED COMPANY

A cost-effective entity used for holding assets, intellectual property (IP), or facilitating transactions within the DIFC’s trusted, and regulated ecosystem.

DIFC FAMILY OFFICE

A regulated platform for managing family wealth, governance, and legacy planning in a globally trusted financial hub.

DIFC HOLDING COMPANY

A strategic entity to manage equity and assets in subsidiaries, enabling efficient control and group operations.

DIFC FOUNDATION FAQs

Yes. A DIFC Foundation can exist in perpetuity unless the Charter specifies otherwise, making it an excellent vehicle for long-term legacy planning.

A DIFC Foundation can legally hold a wide range of assets, including real estate, company shares, intellectual property, bank accounts, and investment portfolios. Creation Business Consultants assists with proper documentation, asset valuation, and compliance to ensure a seamless transfer process.

DIFC Foundations must comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations and maintain non-public beneficial ownership records with the DIFC Registrar. Creation Business Consultants provides expert support to ensure full compliance.

Details of beneficiaries and founders remain private, with only minimal disclosure required to the DIFC Registrar.

DIFC Foundations are recognized in many jurisdictions. However, in some civil law countries, additional legal planning may be necessary.

Yes. DIFC Foundations can be established for charitable, non-charitable, or mixed purposes, and can support grants and philanthropic activities.

A DIFC Foundation can be dissolved in accordance with its Charter or by order of the DIFC Courts, with assets distributed according to its By-laws.