WHAT IS A DIFC

FAMILY OFFICE?

A DIFC Family Office, a DIFC business structure, is a private wealth management entity licensed within the Dubai International Financial Centre (DIFC). It provides a secure and efficient structure for individuals or families to manage and protect their wealth across generations.

Key Functions:

- Management of private capital and investments

- Succession planning and estate administration

- Oversight of philanthropic and charitable foundations

- Global asset protection and risk mitigation

- Multi-jurisdictional tax and compliance planning

Regulated by the Dubai Financial Services Authority (DFSA) and operating under the DIFC’s Common Law legal framework, a DIFC Family Office offers a robust and internationally recognised platform for long-term wealth preservation and strategic planning.

DIFC VS MAINLAND UAE FAMILY OFFICE STRUCTURES

NOTES:

*Mainland regulation varies by emirate and activity (e.g., UAE Central Bank for certain investments).

**Tax exemptions may apply in both jurisdictions for specific activities (e.g., holding companies); consult a tax advisor for compliance with UAE Corporate Tax Law (effective June 2023).

WHO SHOULD CONSIDER A FAMILY OFFICE IN DIFC?

A DIFC Family Office is an ideal solution for:

- High-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals seeking professional wealth management in a tax-efficient and secure jurisdiction

- Family-owned businesses aiming to separate operating companies from personal wealth and succession planning structures

- Entrepreneurs preparing for business exits, liquidity events, or long-term estate planning

- Families with global assets requiring legal clarity, confidentiality, and multi-jurisdictional coordination

- Private wealth advisors, law firms, and accountants collaborating with Creation Business Consultants to design bespoke solutions for elite clientele

Establishing a Family Office in DIFC offers global families a centralized point of control, enhanced asset protection, and alignment with international best practices for managing and preserving wealth across generations.

KEY BENEFITS OF A DIFC FAMILY OFFICE

COMMON PURPOSES OF SETTING UP A DIFC FAMILY OFFICE

Establishing a family office in the DIFC allows high-net-worth individuals and families to create a centralized, purpose-driven platform to manage and preserve wealth across generations.

CASE STUDY: THE AL-MANSOORI FAMILY’S STRATEGIC MOVE TO DIFC FOR SUCCESSION AND INVESTMENT CONTROL

Introduction

The Dubai International Financial Centre (DIFC) is a leading financial hub in the Middle East, Africa, and South Asia (MEASA) region, offering a robust legal and regulatory framework based on common law principles. This case study explores the establishment of a family office in the DIFC for a high-net-worth family, the Al-Mansoori family, seeking to manage their wealth, succession planning, and philanthropic activities efficiently.

Background

The Al-Mansoori family, based in the United Arab Emirates, has accumulated significant wealth through real estate, trading, and investments in technology startups. The family consists of three generations, with assets spread across real estate, private equity, and publicly traded securities, valued at approximately USD 500 million. The family patriarch, Mr. Khalid Al-Mansoori, wishes to centralize wealth management, ensure smooth succession, and support charitable initiatives while maintaining privacy and flexibility.

The family decided to establish a family office in the DIFC to consolidate their financial affairs, streamline decision-making, and leverage the DIFC’s tax-neutral environment and global connectivity.

Objectives

The Al-Mansoori family aimed to achieve the following through their DIFC family office:

- Wealth Preservation: Consolidate and manage diverse investments to ensure long-term growth and stability.

- Succession Planning: Establish a governance structure to facilitate wealth transfer to future generations.

- Philanthropy: Create a framework for structured charitable giving aligned with the family’s values.

- Privacy and Control: Maintain confidentiality and retain control over investment decisions.

- Tax Efficiency: Leverage the DIFC’s tax-neutral environment to optimize returns.

Solution: DIFC Family Office Structure

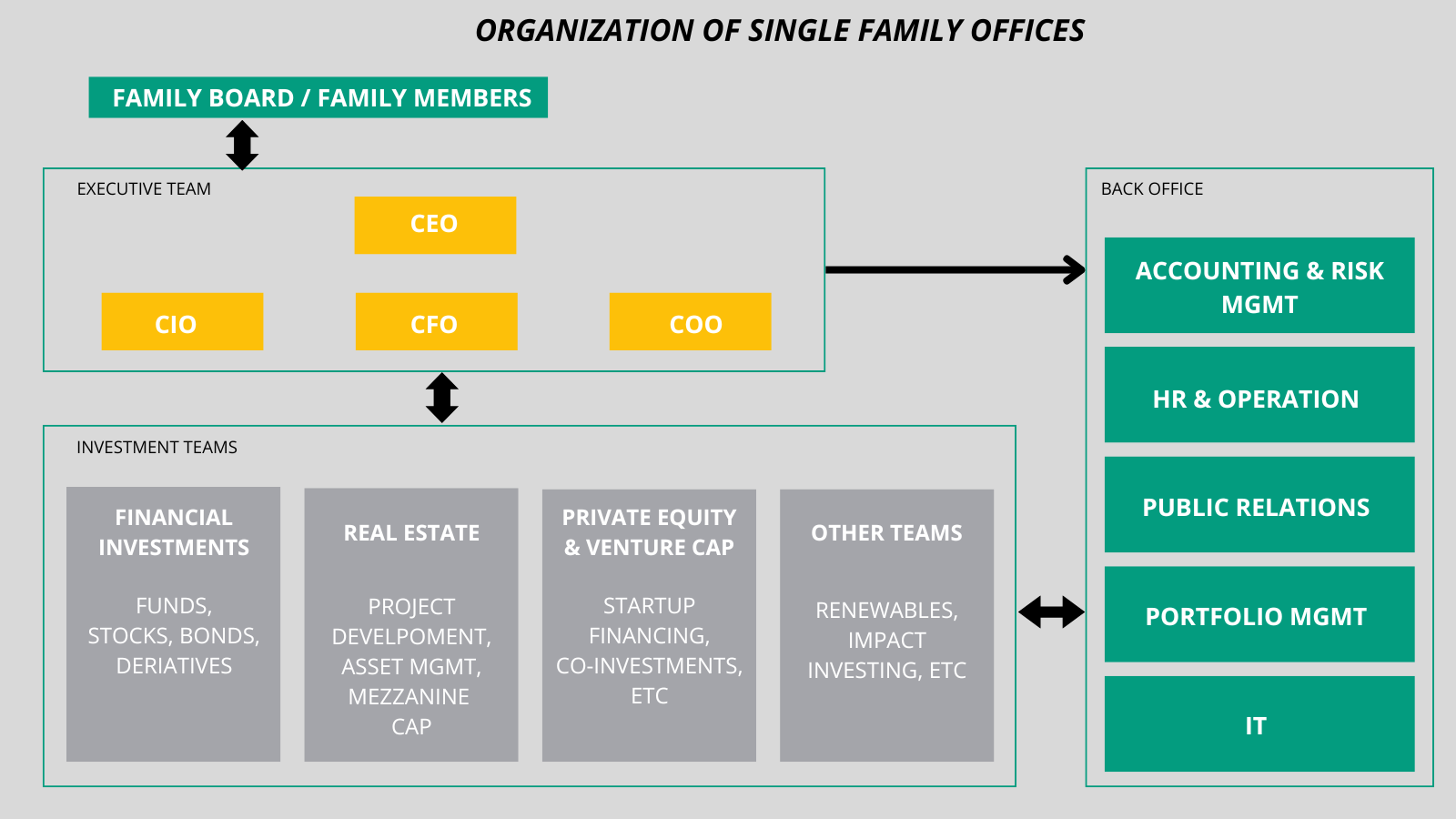

The Al-Mansoori family opted to establish a single-family office (SFO) in the DIFC, registered as a DIFC Company Limited by Shares under the DIFC Companies Law. This structure was chosen for its flexibility, robust legal framework, and ability to operate as a private entity dedicated to the family’s needs.

Key Features of the DIFC Family Office

- Legal Structure: The family office was incorporated as a DIFC Company Limited by Shares, with the family members as shareholders. This allowed centralized control while providing liability protection.

- Governance: A family charter was developed to outline the roles, responsibilities, and decision-making processes. A board of directors, including family members and external advisors, was appointed to oversee operations.

- Regulatory Compliance: The family office registered as a Non-Regulated Entity with the DIFC Authority, as it was not conducting financial services activities requiring oversight by the Dubai Financial Services Authority (DFSA). This minimized regulatory burdens while ensuring compliance with DIFC laws.

- Operational Scope: The family office managed investments, coordinated estate planning, and oversaw philanthropy. It employed a small team, including a chief investment officer, a legal advisor, and an accountant, all based in the DIFC.

- Tax Benefits: The DIFC’s zero-tax regime on corporate income, capital gains, and dividends provided significant tax efficiency. Additionally, the UAE’s extensive double taxation treaty network facilitated cross-border investments.

Implementation Steps

- Incorporation: The family engaged a DIFC-registered corporate service provider to incorporate the family office. The process involved submitting an application to the DIFC Authority, including a business plan, shareholder details, and compliance declarations. The incorporation was completed within two weeks.

- Office Setup: The family leased a small office space in the DIFC, meeting the requirement for a physical presence. They also opted for a flexi-desk option to reduce costs during the initial phase.

- Governance Framework: A family charter was drafted with the assistance of legal advisors, outlining the family’s vision, investment philosophy, and succession rules. A family council was established to involve younger generations in decision-making.

- Investment Strategy: The family office consolidated the family’s assets, including real estate holdings in Dubai, London, and Singapore, and diversified investments into global equities and private equity funds. The office partnered with DIFC-based wealth managers for investment advisory services.

- Philanthropic Arm: A DIFC Foundation was established as a separate entity to manage the family’s charitable activities, focusing on education and healthcare initiatives in the UAE and abroad. The Foundation was funded through dividends from the family office’s investments.

- Compliance and Reporting: The family office appointed a compliance officer to ensure adherence to DIFC regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Annual financial statements were prepared in accordance with International Financial Reporting Standards (IFRS).

Outcomes

- Centralized Wealth Management: The family office provided a single point of oversight for the Al-Mansoori family’s global assets, improving efficiency and reducing administrative costs.

- Successful Succession Planning: The family charter and governance structure ensured clear guidelines for wealth transfer, minimizing potential disputes among heirs.

- Philanthropic Impact: The DIFC Foundation enabled structured giving, with USD 5 million allocated to education programs in the first year.

- Tax Optimization: The DIFC’s tax-neutral environment maximized returns on investments, with no corporate tax or withholding tax on dividends.

- Privacy and Control: The private nature of the DIFC Company Limited by Shares ensured confidentiality, while the family retained full control over investment decisions.

Challenges and Considerations

- Setup Costs: Initial costs, including incorporation fees, office leasing, and professional services, amounted to approximately USD 50,000. Ongoing operational costs, including staff salaries and compliance, were budgeted at USD 200,000 annually.

- Regulatory Compliance: While the family office was non-regulated, it still required adherence to DIFC’s AML and KYC regulations, necessitating robust internal processes.

- Talent Acquisition: Attracting skilled professionals, such as investment managers, in a competitive market like the DIFC was challenging but mitigated by leveraging the DIFC’s network of service providers.

- Cross-Jurisdictional Issues: Managing assets across multiple jurisdictions required coordination with international legal and tax advisors to ensure compliance with foreign regulations.

Conclusion

The establishment of a family office in the DIFC provided the Al-Mansoori family with a robust, tax-efficient, and flexible platform to manage their wealth, plan for succession, and pursue philanthropic goals. The DIFC’s common law framework, global connectivity, and business-friendly environment made it an ideal jurisdiction for the family office. While setup and operational costs presented challenges, the long-term benefits of centralized management, privacy, and tax optimization outweighed these hurdles.

ESTABLISH YOUR DIFC FAMILY OFFICE WITH US

Bespoke structuring for wealth consolidation, governance, and intergenerational legacy.

EXPERT CONSULTATION

Partner with Creation Business Consultants for tailored advice on how a DIFC Family Office can support your wealth management, succession planning, investment oversight, or multi-generational governance goals.

STRATEGY & STRUCTURE DESIGN

Our specialists in private wealth, regulatory compliance, and family governance help you define the Family Office’s role, structure the legal entities, and align it with your personal, family, or business objectives.

SEAMLESS SETUP & LICENSING

While you focus on your family’s long-term vision, we manage:

- Incorporation under DIFC regulations

- DFSA engagement (if required)

- Appointment of directors, advisors, or investment committee

- Setup of supporting structures (e.g., holding companies, foundations, trusts)

- Assistance with asset consolidation and account opening

ONGOING OFFICE & COMPLIANCE SUPPORT

We continue to support you after the family office is established by:

- Annual renewals and reporting to DIFC/DFSA

- Corporate secretarial and compliance support

- Governance reviews, investment oversight, and structural updates

- Strategic advice for succession, tax efficiency, and cross-border asset management

EXPLORE OTHER DIFC COMPANY STRUCTURES

DIFC PRESCRIBED COMPANY

A cost-effective entity used for holding assets, intellectual property (IP), or facilitating transactions within the DIFC’s trusted, and regulated ecosystem.

DIFC FOUNDATION

A tax-efficient entity for wealth protection, family planning, philanthropy, and holding assets in a secure jurisdiction.

DIFC HOLDING COMPANY

A strategic entity to manage equity and assets in subsidiaries, enabling efficient control and group operations.

DIFC FAMILY OFFICE FAQs

A Single-Family Office serves one family exclusively, while a Multi-Family Office serves multiple unrelated families. At Creation, we advise on the appropriate structure based on your goals, complexity, and scale.

Yes, depending on the services offered (e.g., asset management vs. administration only), a license from the DIFC Registrar or the Dubai Financial Services Authority (DFSA) may be required. Creation will guide you through the entire regulatory process.

Absolutely. DIFC structures are internationally recognized and can hold shares, real estate, bank accounts, and IP globally.

With Creation managing the process, setup can take 2 to 6 weeks, depending on complexity, licensing needs, and documentation. Experts at Creations ensure a smooth and compliant setup from start to finish.

DIFC entities benefit from privacy, protection under Common Law, and mechanisms like foundations and trusts for enhanced confidentiality.

As a DIFC-registered corporate service provider, Creation handles everything from initial structuring advice and licensing to incorporation, compliance, and governance frameworks.

Yes. Our team works with families to design governance frameworks, family charters, succession strategies, and decision-making protocols—essential for multi-generational wealth preservation.